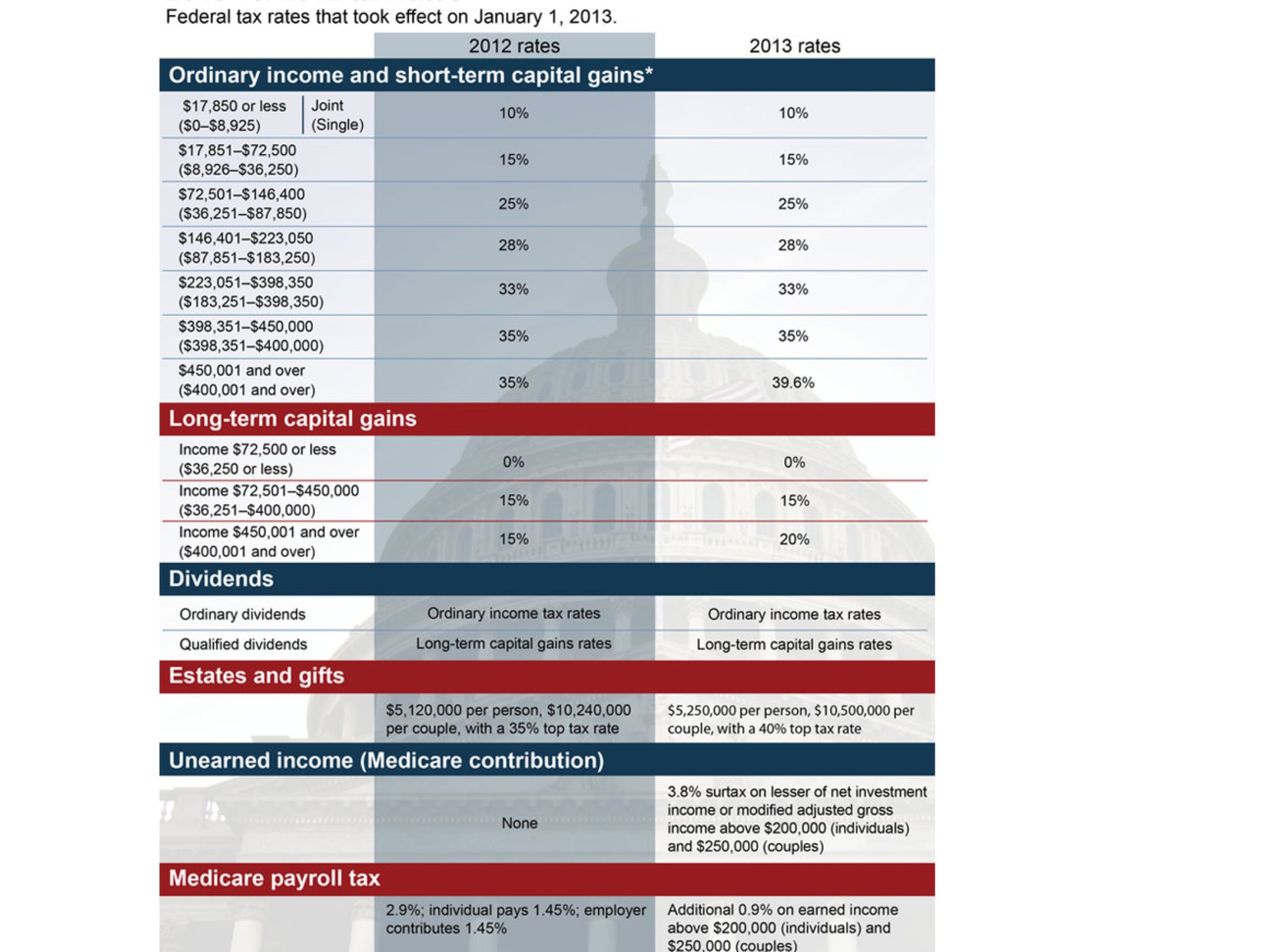

In addition to regular income tax rates, some taxpayers may find that one or more surtaxes will apply to their incomes:

A 3.8% net investment income surtax applies if adjusted gross income (with some modifications) exceeds certain thresholds.

|

Net Investment Income Tax Thresholds |

|

| Filing status | Modified Adjusted Gross Income |

| Married Filing Jointly or Qualifying Widow(er) | $250,000 |

| Single or Head of Household | $200,000 |

| Married Filing Separately | $125,000 |

And an additional Medicare surtax of 0.9% on wages or net-self employment income above certain thresholds.

|

Additional Medicare Tax Thresholds |

|

| Filing status | Medicare Wages and/or Self-Employed Income in Excess of |

| Married Filing Jointly | $250,000 |

| Single or Head of Household or Qualifying Widow(er) | $200,000 |

| Married Filing Separately | $125,000 |