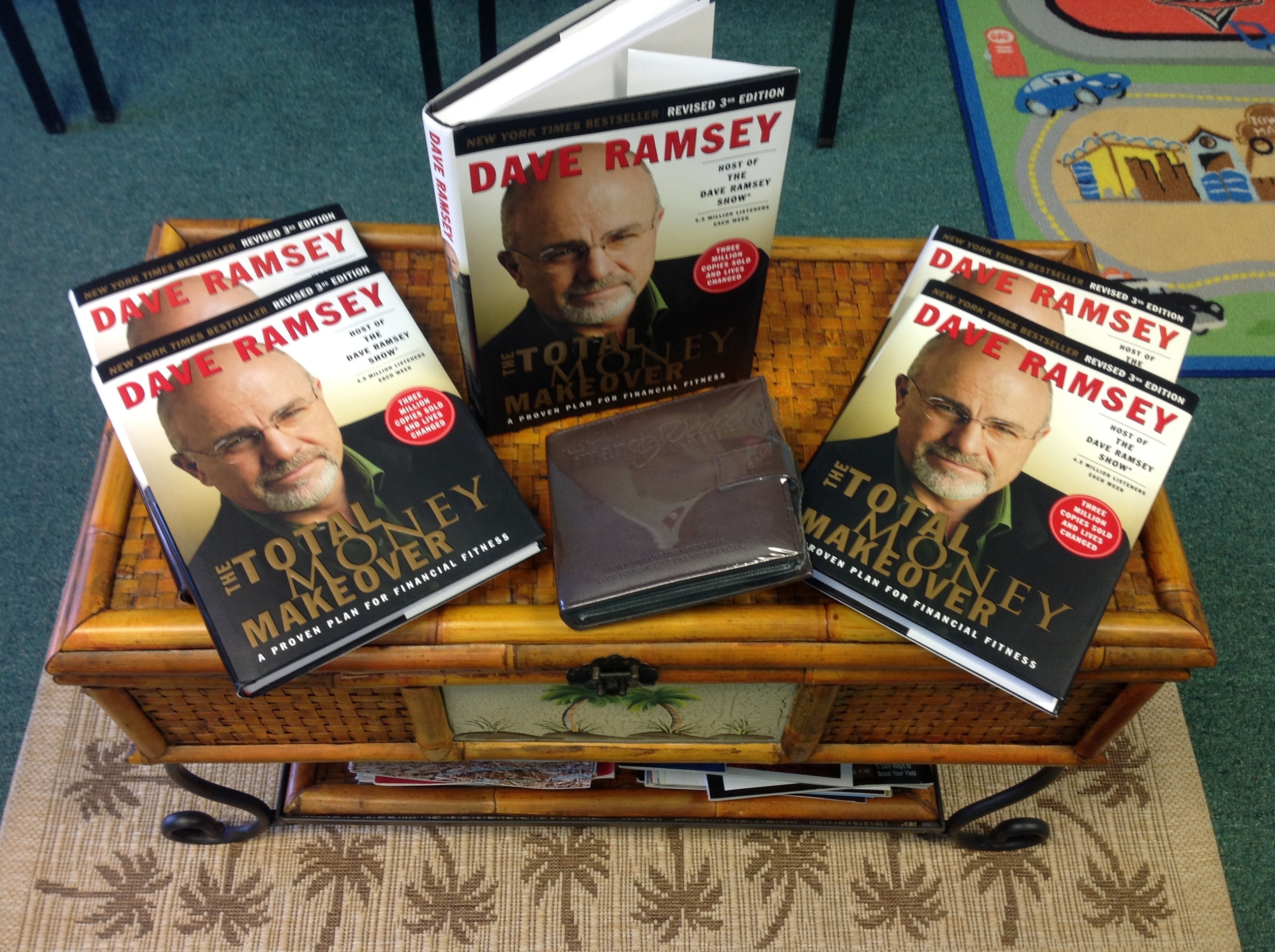

Heather Worrell, Enrolled Agent and owner of A Tax Haven, celebrates 25 years this January in the tax industry. She is also an Endorsed Local Tax Provider (ELP) for Dave Ramsey! In recognition of this special anniversary, A Tax Haven will be offering a Dave Ramsey Give A Way (Several Dave Ramsey Total Money Makeover Books & a set of Financial Peace University CDs) to help others learn more about handling their finances and budgeting. Current clients will be automatically entered into the drawing. All others need to fill out the contact form on this site to be entered in the drawing. Feel free to leave a respectful comment with a finance tip below. Send your friends to this blog at ataxhaven.org for their chance to win! Drawing will be held March 29th.

And as Dave Ramsey always says, “If you live like no one else, later you can live like no one else.”

CONGRATULATIONS to our Dave Ramsey Give A Way Winners at A Tax Haven- March 2013:

Megan Ladd

Kenneth & Corita Meredith

George Soper

Phyllis Gardner

Josephine Nash

Jimmy & Derlene Montgomery