REMINDER: Put all your tax documents into your green A Tax Haven bag as they come in the mail!

***There have been multiple changes for the 2021 filing season:

including additional pages of tax forms, extending some credits and rules while removing many others, as well as the addition of several new rules and credits just for the 2021 filing season!

You may now qualify for some credits that you may not have qualified for in the past!

The best way to gather all of your tax data!

Here are some tax reform laws to be aware of and some strategies to use by the end of the year:

- Be Generous -2021 Non-Itemizer Donation Rules

- FOR 2021 ONLY- like 2020, you are able to take a tax deduction for charitable donations of money to a qualified organization even if you don’t have enough deductions to itemize! For 2021- the credit of $300 for single taxpayers & $600 for couples is deductible after AGI, and the cash contribution limit is also increased to 100% for Schedule A itemizers.

- It’s important to remember that you MUST have a receipt to back up your contributions! This will be an audit spot so be sure to print and keep those receipts!

- Reduce Your Taxable Income by Contributing to Retirement Plans

- Max Out your Retirement Plans by December 31st

- Check with your employer for guidelines on your current 401K/403B

- Contribute to your IRA / SEP IRA

- If you are self-employed, you can also set up a SIMPLE or SEP

- Remember, for those over 50, you can add an additional $1000 catch-up amount to your IRA contributions

- Contributing to your retirement may also make you eligible for a Saver’s Credit of up to $1,000

- Max Out your Retirement Plans by December 31st

- Miss the December 31st deadline? You can still contribute to your IRA or ROTH IRA by April 18, 2022, for the 2021 year.

- Required Minimum Distributions for those 72 or older are required in 2021. Check with your retirement company if you haven’t already taken your RMD for the year.

- Postpone Income

- While it may be difficult to postpone wages or salaries, try to defer a year-end bonus to be paid out in January of the new year. Just make sure this is standard practice for your company.

- If you are self-employed or are a freelancer/consultant, you can delay billings until late December to ensure you don’t receive payment until the new year.

- Keep in mind that if you anticipate additional income for the new year, it could push you into a higher tax bracket then, so use this tip with caution.

- Business Owners Can Eat Out Again

- For 2021 & 2022 ONLY- Business Meals purchased in restaurants can be deducted at 100%!

- Reminder – business meals must have been incurred while traveling out of town on business or be provided for clients, customers, or employees while business is discussed and tips are included

- Children Credits Large Increase- Child Tax Credit, Earned Income Credit, Dependent Care Credit

- For 2021 ONLY- the CTC, EIC, & DCC have all increased and been made more refundable

- For 2021, there have been numerous changes made to these credits, including EIC age requirements without children & CTC available for dependents up to age 17

- The Kiddie Tax is back in action for dependents with unearned income over $2200

- The EIC for 2021 & beyond has increased the investment income limitation to $10,000

- Economic Impact Payments & Child Tax Credits Pre-Payments

- For 2021, taxpayers will be required to reconcile their 3rd Stimulus EIP Payment on their tax return. This was received in approximately March/April or later in 2021 and was up to $1400 per person. You will need to know the amount received for your taxes.

- For 2021, some taxpayers received an advance payment of CTC in July through December. This will have to be reconciled on the tax return, as well.

- **In January 2022, the IRS will send you Letter 6419 to provide the total amount of advance Child Tax Credit payments that were disbursed to you during 2021. Please keep this letter regarding your advance Child Tax Credit payments with your tax records.

- College

- You may be eligible for the American Opportunity Tax Credit or the Lifetime Learning Credit if you are a college student

- If you pay for college courses for the first quarter/semester of the new year by December 31st, you may be able to increase your credit if you did not have enough tuition already paid to meet the $4,000 needed for the maximum credit

- Student loan interest can also be deducted up to $2,500 if you are making payments.

- Loss Harvesting

- Sell investments to offset taxable gains – dollar for dollar

- If you still have a capital net loss, up to $3,000 can reduce other taxable income.

- More than $3,000 can be carried over to the next tax year!

- Through 2025- excess business losses can be used against other types of income

- Net Operating Losses also have new rules in 2021- they are limited to 80% of taxable income, are not available for carryback, and NOLs from 2018 forward can be carried forward indefinitely until used up

- Health and Dependent Care Flex Spending Accounts

- Flex accounts avoid income tax and social security taxes so they are a benefit to you, but not taxable to you

- For 2021, there are different rules allowing more carryovers of funds to the new year

- Maximize Itemized Deductions – Reminder- You can often itemize on your AR return even if you don’t have enough to itemize on the federal return!

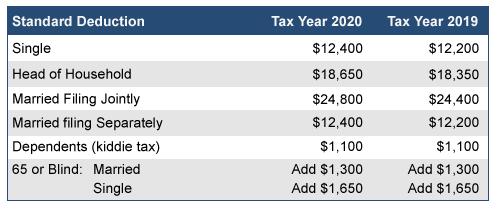

- The standard deduction has increased this year, up to $12,550 single (or $25,100 if you are married and filing jointly OR $18,800 for Head of Household). If your deductions are right at those max amounts, here are some options for you:

- Donate more to charity

- Pay additional medical bills, but keep in mind the medical floor is anything over 7.5% of your AGI – which has been made a permanent law now

- Pay additional state, real estate, or personal taxes by combining years

- The standard deduction has increased this year, up to $12,550 single (or $25,100 if you are married and filing jointly OR $18,800 for Head of Household). If your deductions are right at those max amounts, here are some options for you:

- Unemployment in 2021

- Unemployment in 2021 is taxable income at this time. In 2020, up to $10,200 of unemployment was not taxable

- Mileage Deductions for 2021- some actually lowered!

- Standard Mileage Rates for:

- Business 56 cents

- Charitable 14 cents

- Medical 16 cents

- Moving 16 cents

- Depreciation 26 cents

- 1099 NEC- Non Employee Compensation

- Reminder- 2020 and beyond- Contract laborers should receive their income on a form 1099-NEC instead of a 1099-Misc

- IRS Online Tax Accounts – irs.gov

- You can set up your online tax account to view your balance, download IRS notices and letters, make and view payments, and to access tax records. You will need to be able to verify your identity with them first.

- You can also request an IPIN- a six digit number assigned to eligible taxpayers to prevent the misuse of their social security number on fraudulent tax returns. This number is reissued each year and must be used on your tax return to file.

- Social Security Online Accounts – ssa.gov

- You can set up this account to verify your earnings are showing correctly on your social security account and to see other information about your social security.