2018 Tax Rates for Individual Income Tax Returns (Filed in 2019)

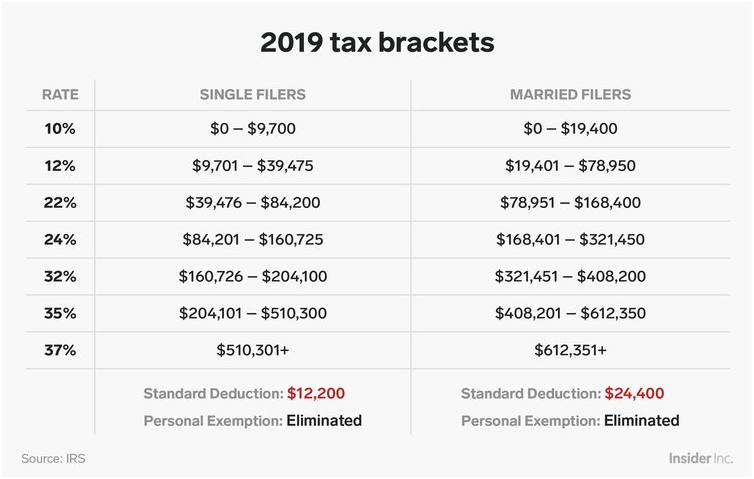

The Federal income tax has 7 rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The amount of tax you owe depends on your income level and filing status.

NOTE: There are no personal exemption amounts for 2018.

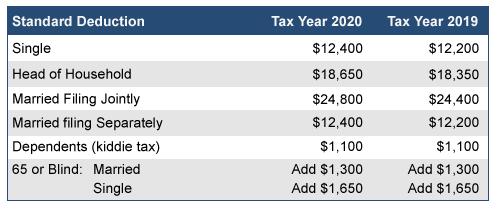

The standard deduction is subtracted from your Adjusted Gross Income (AGI), which means it reduces your taxable income. (Note that there is an additional standard deduction for elderly and blind taxpayers, which is $1,300 for tax year 2018. This amount increases to $1,600 if the taxpayer is also unmarried.)

For tax year 2018, the standard deduction amounts are as follows:

Filing Status Standard Deduction

Single $12,000

Married Filing Jointly or Qualifying Widow(er) $24,000

Married Filing Separately $12,000

Head of Household $18,000

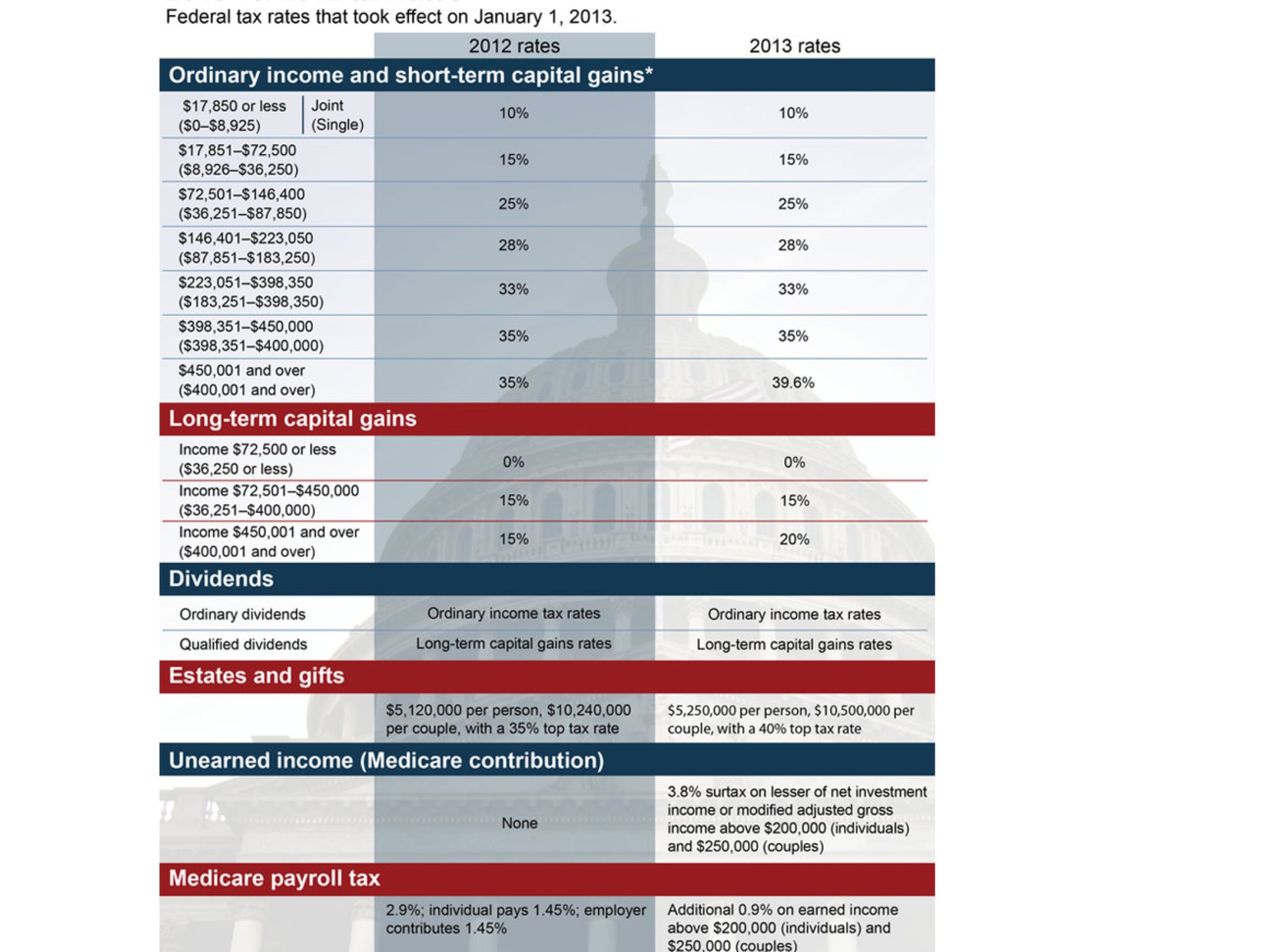

The 2018 tax rates are new take effect under the Tax Jobs and Cuts Act of 2017, which was signed into law by President Trump on December 22, 2017. These tax changes are effective as of January 1, 2018. While there are still 7 tax brackets, the rates have decreased overall. (These lower tax rates will expire in 2025, unless Congress votes to extend them.) The top rate is reduced from 39.6% to 37%. The bottom rate is still 10%, but it includes higher income.

Single

Taxable Income Tax Rate

$0 – $9,525 10% of taxable income

$9,526 – $38,700 $952.50 plus 12% of the amount over $9,525

$38,701 – $82,500 $4,453.50 plus 22% of the amount over $38,700

$82,501 – $157,500 $14,089.50 plus 24% of the amount over $82,500

$157,501 – $200,000 $32,089.50 plus 32% of the amount over $157,500

$200,001 – $500,000 $45,689.50 plus 35% of the amount over $200,000

$500,001 or more $150,689.50 plus 37% of the amount over $500,000

Married Filing Jointly or Qualifying Widow(er)

Taxable Income Tax Rate

$0 – $19,050 10% of taxable income

$19,051 – $77,400 $1,905 plus 12% of the amount over $19,050

$77,401 – $165,000 $8,907 plus 22% of the amount over $77,400

$165,001 – $315,000 $28,179 plus 24% of the amount over $165,000

$315,001 – $400,000 $64,179 plus 32% of the amount over $315,000

$400,001 – $600,000 $91,379 plus 35% of the amount over $400,000

$600,001 or more $161,379 plus 37% of the amount over $600,000

Married Filing Separately

Taxable Income Tax Rate

$0 – $9,525 10% of taxable income

$9,526 – $38,700 $952.50 plus 12% of the amount over $9,525

$38,701 – $82,500 $4,453.50 plus 22% of the amount over $38,700

$82,501 – $157,500 $14,089.50 plus 24% of the amount over $82,500

$157,501 – $200,000 $32,089.50 plus 32% of the amount over $157,500

$200,001 – $300,000 $45,689.50 plus 35% of the amount over $200,000

$300,001 or more $80,689.50 plus 37% of the amount over $300,000

Head of Household

Taxable Income Tax Rate

$0 – $13,600 10% of taxable income

$13,601 – $51,800 $1,360 plus 12% of the amount over $13,600

$51,801 – $82,500 $5,944 plus 22% of the amount over $51,800

$82,501 – $157,500 $12,698 plus 24% of the amount over $82,500

$157,501 – $200,000 $30,698 plus 32% of the amount over $157,500

$200,001 – $500,000 $44,298 plus 35% of the amount over $200,000

$500,001 or more $149,298 plus 37% of the amount over $500,000